the allowance method is required by

Which method is required by the GAAP. One calculates this estimate by assuming a certain.

|

| The Allowance Method For Uncollectible Accounts How To Calculate Bad Debt Expense Video Lesson Transcript Study Com |

In this method we record the bad debt expense at the time when it actually arises.

. At the end of each accounting period. The allowance method is used in accounting to create contra for the debtors that are expected to be uncollectible. In accounting a method by which one estimates the bad debt a company will acquire each accounting period. In the same year as the credit sale.

The allowance method of accounting for uncollectible accounts is required if. The first method is generally used for taxation purposes. 1Direct write-off method 2None of these 3Allowance method 4Indirect write-off method. The allowance method anticipates and prepares for a certain amount of unpaid debt while the direct write-off method deals with the debt only after it hasnt been paid.

Accounting questions and answers. The allowance method is a technique for estimating and recording of uncollectible amounts when a customer fails to pay and is the preferred alternative to the direct write-off. For companies that factor their receivables. Management uses the allowance for doubtful accounts method to estimate credit accounts that customers will not pay.

The allowance method of accounting for uncollectible accounts Bad Debt Expense is debited. Apply the direct write-off method for uncollectibles When using the allowance method. In the year after the credit sale is made. The allowance method is required for financial reporting purposes when bad debts are material.

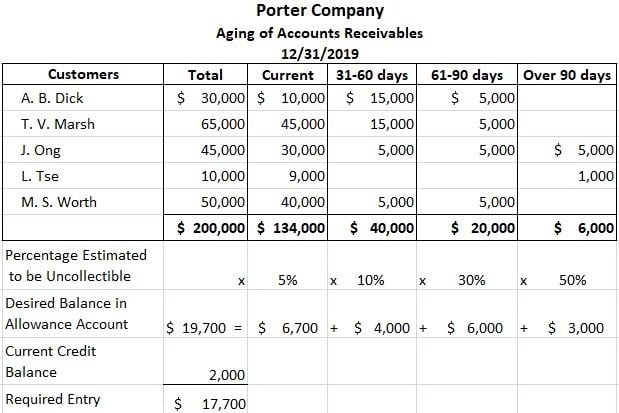

The term allowance in allowance method refers to the estimated amount of accounts receivable out of the total credit sales that a company believes will not be collected. Under the allowance method a company records an adjusting entry at the end of each accounting period for the amount of the losses it anticipates as the result of extending. Where receivables are a small part of the current. So the allowance method allows organizations to create.

There is no general rule. - this means that at the end of each period the allowance method requires an estimate of the total bad debts expected from that periods sales. The allowance method works by using the allowance for doubtful accounts account to estimate the amount of receivables that are going to be uncollected in the future. What are two advantages that the allowance.

Three essential features of the allowance method are. Method violates the matching principle and is not the method required by GAAP. The allowance method is required. This method is not preferable by the GAAP and.

21 of 25 The allowance method is required a. Companies dont immediately write off accounts. Sometimes the direct write-off for the account balance does not seem logical as the business may be unable to locate which debtor should be written off.

|

| Bad Debt Recovery Guide For Small Business Owners |

|

| How To Use The Percentage Of Ar Method To Establish The Allowance For Doubtful Accounts Reserve Universal Cpa Review |

|

| Accounting The Key To Success |

|

| Click To Edit Master Title Style 1 1 1receivables Ppt Download |

|

| Solved From Inception Of Operations Murr Company Provided For Uncollectible Accounts Expense Under The Allowance Method Provisions Were Made Mont Course Hero |

Posting Komentar untuk "the allowance method is required by"